south dakota sales tax rate

Communities all across the country are announcing local sales tax rate changes taking effect on January 1 2015. Other local-level tax rates in the state of South.

South Dakota Sales Tax Rate Changes January 2014 Avalara

One field heading that incorporates the term Date.

. With local taxes the. The most recent news comes from South Dakota where local tax. The tax data is broken down by zip code and additional locality information.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The base state sales tax rate in South Dakota is 45. 2022 South Dakota state sales tax.

Local tax rates in South Dakota range from 0 to 2 making the sales tax range in South Dakota 45 to 65. 366 rows 2022 List of South Dakota Local Sales Tax Rates. This is the total of state county and city sales tax rates.

Average Local State Sales Tax. We provide sales tax rate databases for. Depending on local municipalities the total tax rate can be as high as 65.

The minimum combined 2022 sales tax rate for Sioux Falls South Dakota is 65. Lowest sales tax 45 Highest sales tax 75 South Dakota Sales Tax. What is the sales tax rate in Yankton South Dakota.

Maximum Possible Sales Tax. Exact tax amount may vary for different items. One field heading labeled Address2 used for additional address information.

The South Dakota SD state sales tax rate is currently 45. The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583. The total tax rate might be as high as 65 percent depending on local municipalities.

What is the sales tax rate in Sioux Falls South Dakota. 31 rows The state sales tax rate in South Dakota is 4500. This is the total of state county and city sales tax.

South Dakota State Sales Tax. Find your South Dakota. The minimum combined 2022 sales tax rate for Yankton South Dakota is.

South Dakota has a 45 statewide sales tax rate. General Municipal Sales Tax. Maximum Local Sales Tax.

Simplify South Dakota sales tax compliance. Rate search goes back to 2005. The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services.

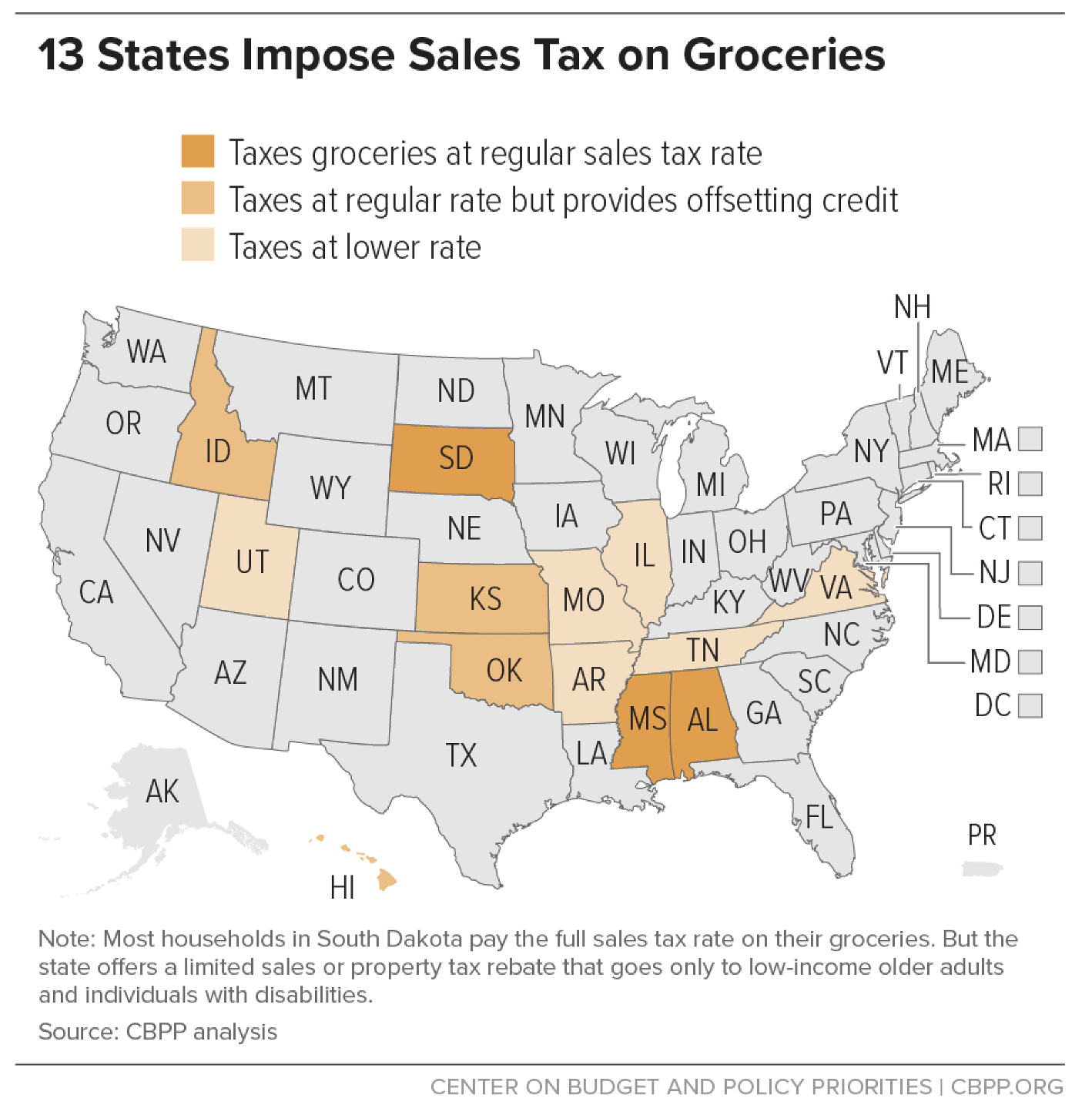

Currently South Dakota is one of three states that impose a full. On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 and 2. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the.

Raised from 45 to 65. The current state sales tax rate in South Dakota SD is 45 percent. The minimum combined 2022 sales tax rate for Black Hawk South Dakota is.

All businesses licensed in South Dakota are also required to collect and remit municipal sales or use tax and the municipal gross receipts tax. Average Sales Tax With Local. Our dataset includes all local sales tax jurisdictions in South Dakota at state county city and district levels.

Noem said the proposed policy would be worth more than 100 million in tax cuts the largest in state history. Raised from 45 to 65. What is the sales tax rate in Black Hawk South Dakota.

This is the total of state county and city sales tax rates.

Pro Growth Tax Reform Through Broadening Sales Tax Itr Foundation

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Democrats Persuade Noem To Promise Food Tax Repeal Smith Winning Dakota Free Press

How To File And Pay Sales Tax In South Dakota Taxvalet

Sales Tax Laws By State Ultimate Guide For Business Owners

Sales Tax 2021 Lookup State And Local Sales Tax Rates Wise

New Sales Tax Landscape For Online Sellers Vertex Inc

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

South Dakota Is A Low Tax State Overall But Not For Families Living In Poverty Itep

South Dakota V Wayfair Decided June 21 2018 Subscript Law

South Dakota Taxes Sd State Income Tax Calculator Community Tax

South Dakota Department Of Revenue Wondering How South Dakota S Sales Tax Rate Has Changed Through The Years See The Timeline Below Or You Can Visit Https Dor Sd Gov Businesses Taxes Sales Use Tax To View Current And Historical

Sales Use Tax South Dakota Department Of Revenue

North Dakota Sales Tax Rate Table Woosalestax Com

Historical South Dakota Tax Policy Information Ballotpedia

Permanent Grocery Tax Cut Proposed By South Dakota Gov Kristi Noem

Tax Rates To Celebrate Gulfshore Business

General Sales Taxes And Gross Receipts Taxes Urban Institute